As new benchmarking products showing returns at the deal level hit the market, PE Stack examines the key considerations for those considering adding private equity deal-benchmarking to their data and technology stacks and speaks to some of the key vendors in the space about their products.

Background

Meaningful benchmarks require accurate, consistent data flowing from a representative sample set as free from biases as possible.

Barring a couple of exceptions for specific countries or sectors, publicly reported deal financials within private equity fail to satisfy most if not all of these criteria! As a result, deal-level benchmarking requires an alternative approach, with innovative vendors launching initiatives to aggregate proprietary data sources to produce benchmarking products.

Data Sources and Challenges

Benchmarking initiatives are generally driven by accessing data provided to LPs by GPs. Unlike fund-level performance, which can be gathered using Freedom of Information Act requests to publicly funded institutional investors such as pension funds, data pertaining to underlying portfolio investments are generally exempted from public information requests due to the commercial sensitivity of such data.

A vendor seeking to create a benchmarking product therefore requires two things - relevant client data flowing through its existing products and workflows plus voluntary or contractual cooperation from LPs and GPs to aggregate and produce benchmarks. There are some nuances to data sources which are important to understand as they can affect functionality and granularity within the end product. Potential data sources include:

Diligence Data

Here we are talking about data provided to prospective LPs as part of a fund diligence process. Vendors which provide LPs with tools to analyze track records as part of a diligence process may be able to access and aggregate deal-level data loaded onto their platform. Tools of this nature can also be owned by the GP. Perhaps the best scenario for leveraging this type of data is a platform where GPs are granting LPs permission to access their track record over a network as this setup is more likely to see consistency in terms of data format and categorization.

Ongoing Reporting – Schedule of Investments

Here we are talking about data which LPs receive from GPs showing ongoing performance of assets within an active fund, typically contained within a schedule of investments document. Platforms which provide portfolio monitoring services to LPs have the potential to access and aggregate this data to produce benchmarks, as do Intelligent Document Processing platforms which process and extract data from these documents as a standalone service.

Service Providers

It is worth noting that software vendors are not the only players with potential access to this data. Fund administrators, investment consultants, placement agents, and even large LPs could conceivably seek to aggregate, anonymize, and commercialize deal-level benchmarks. We are aware of numerous initiatives at various stages of development within the service-provider arena.

Public, Semi-Public Data

Although it is rare to find private equity deal financials in the public realm, certain data points can be gathered. Various groups - including industry associations and data providers - have opportunities to seek out data both voluntarily and via innovative research channels.

Challenges

Portfolio company data is often messy, at least from an aggregation perspective. The way in which such data is reported is inconsistent and not conducive to easy aggregation. Vendors seeking to put in place aggregation plays must normalize data by geography, industry, and type. They must deal with scenarios like add-ons and duplicates with consistency. Underestimating the challenge in getting this right will cause initiatives to go over budget in terms of cost and time or fail altogether. Vendors which already maintain a research function and can efficiently link raw data to normalized market data sets will have a natural advantage here.

Finally, and crucially, there are legal considerations to bear in mind. GPs do not want commercially sensitive data on their underlying portfolio in the public sphere (even if they are happy to buy these products). Many are wary of aggregation plays and such concerns are often shared by LPs.

We are not aware of any GP-focused pure-play technology platforms which are seeking to aggregate portfolio data directly and seriously doubt that such a move would be viable in today’s market. Dotting I’s and crossing Ts in terms of seeking aggregation rights from LPs is one thing, but anyone developing such tools must ensure that their product cannot be subject to slicing and dicing which might reveal the identity and metrics for individual deals or they could find themselves in a very tricky situation!

Mapping Data Sources with Use-Cases

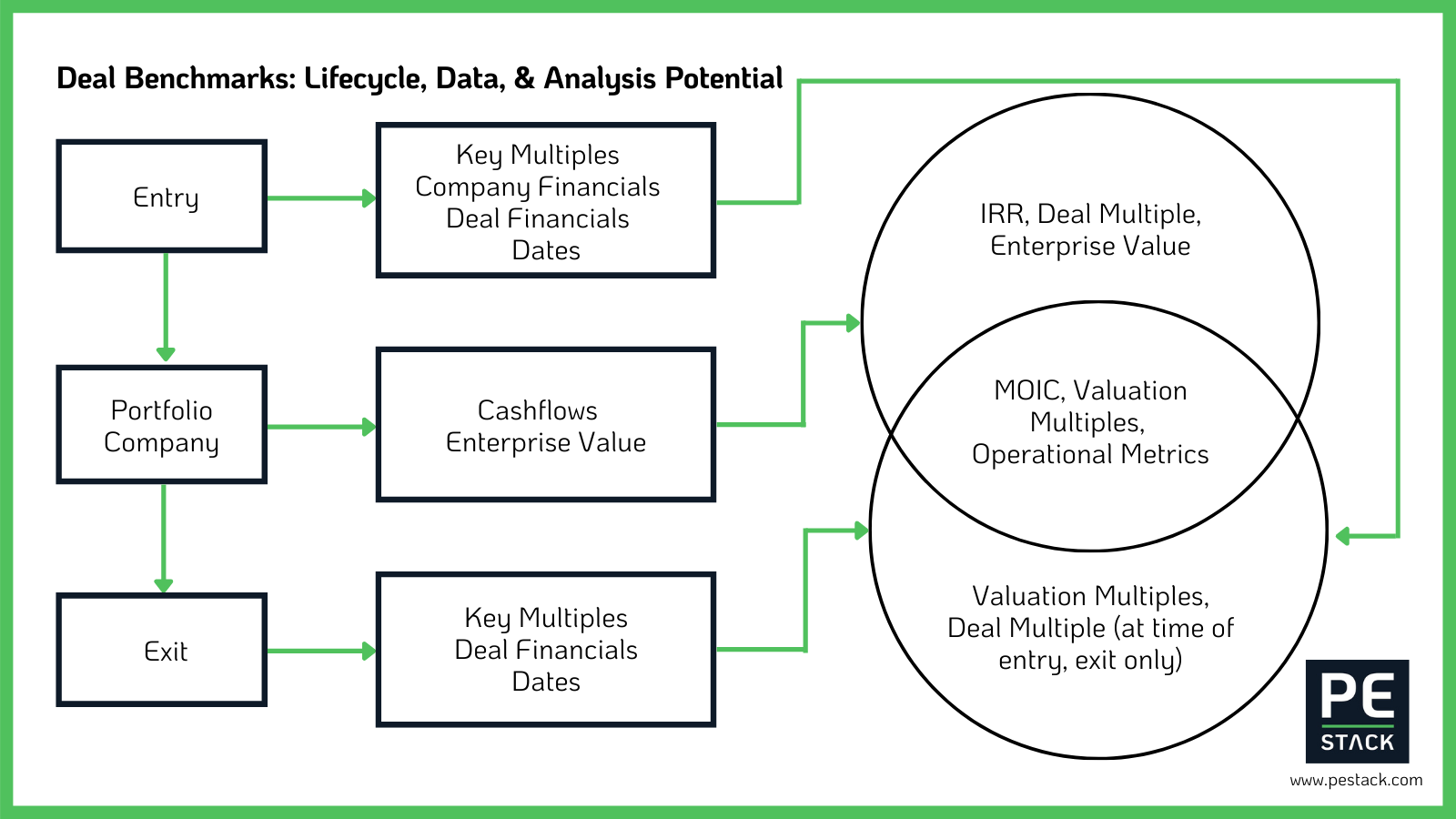

This area is still in its infancy, and we expect to see more use cases for the data emerging in time. That said, there are already some compelling uses for deal benchmarks. The extent to which this data can be used for certain use cases is very much dependent on the functionality and underlying sources of any given provider.

Sector Strategy and Thesis

Which areas of the market present the most compelling opportunities in terms of industry, geography, and size? GPs can analyze both the size and range of returns from past vintages as an input in determining ongoing thematic strategies. The ability of a product to filter at a granular level is important here.

A slight variation of this would be to leverage benchmarks as part of LP fundraising efforts to show the relative appeal of sectors which the GP has already identified for an upcoming fund.

Sophisticated LPs may also incorporate this data when establishing investment strategy and defining the scope for fund investing.

Deal Diligence

An understanding of typical returns can help determine appropriate bids and support investment committee proposals with hard data.

GP Portfolio Monitoring

Comparing the current performance of unrealized investments vs peers can be a useful tool in assessing relative performance, exit strategy, where proactive intervention might be needed, and other similar use cases.

Weighted / Advanced GP Benchmarking (LP Due Diligence)

LPs, and GP investor relations teams, can leverage deal-level benchmarks to better understand/portray past performance, allowing LPs to make more informed assessments of past investments relative to the wider market.

Vendors and Buyer Considerations

For both GPs and LPs looking to incorporate deal benchmarking products within their market intelligence stack, it is important to identify the use cases for the data and assess the products on their ability to fulfill these use cases. Does the product being assessed allow for the right level of granularity? Is the taxonomy correct? Is there data showing ongoing performance of unrealized assets (if this matters to the buyer)? What analysis can be conducted on the platform? It is especially important to dictate the use case and areas of interest when assessing the viability of individual products and not rely on generic demonstrations.

It is also important to consider how the data will be accessed. For LPs, the presence of deal or industry-level benchmarks may form part of a wider set of requirements when considering portfolio monitoring applications. GPs may look for the ability to integrate deal benchmarking data within other products already in use.

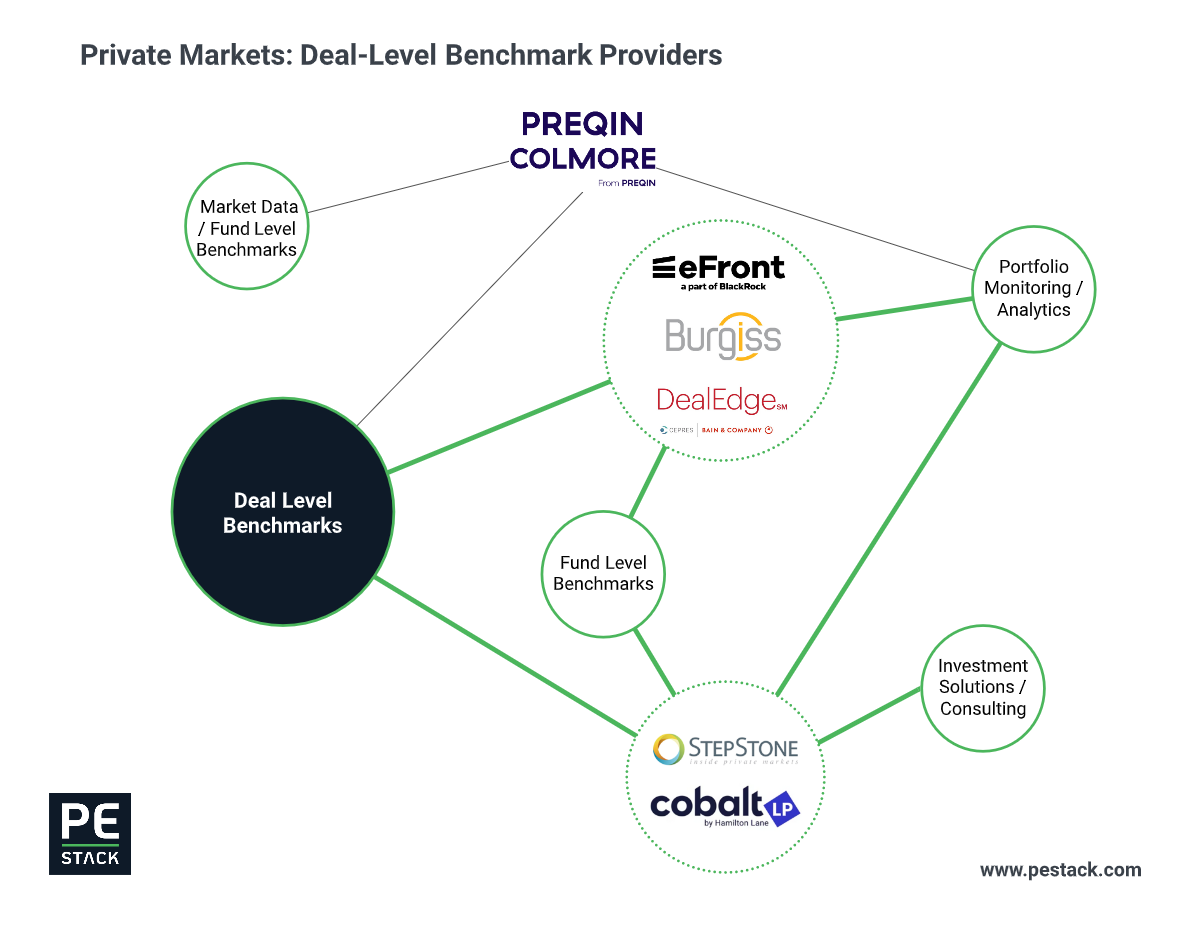

Key Vendors which have already launched or announced plans to launch products which show deal-level benchmarks or closely related tools include: Bain, Cepres and Dealedge (a joint initiative); Burgiss; Cobalt LP and Hamilton Lane; Efront (a Blackrock Company); Preqin. More will follow within the next year. Many traditional market data providers can provide raw data for a small but still meaningful subset of the private market. Others are leveraging public data to provide M&A metrics which to an extent cross over with certain use cases outlined here.

Having experienced both existing solutions and those under development, we feel that this emerging area of the market intelligence sphere has some compelling and powerful products with value-add potential for both LPs and GPs. We expect to see evolution in terms of more products entering the market and initiatives to better integrate the data with core workflow applications such as portfolio monitoring.

There are nuances to these products and some are better suited to certain tasks than others. For more information on deal benchmark providers and applications, please give us a call, we’d love to share our views and help you select the best platform for your needs.

In addition to fund-level benchmarking, the Burgiss suite of solutions allows LPs, GPs, and other private market participants to benchmark individual deals relative to the nearly 220k underlying investment holdings within the Burgiss Manager Universe sourced exclusively from GP to LP reporting. The performance of holdings can be filtered interactively by industry and geography of the portfolio company, vintage year of the holding, and strategy and vintage year of the fund. Performance measures include IRR, TVPI, and valuation. In addition, Burgiss publishes a quarterly summary of entry and exit multiples of nearly 16k holdings.

Brian Schmid

Managing Director & Head of Private Capital Product Management & Applied Research, Burgiss

CEPRES data comes directly from GPs and asset owners, who verify every single data point, offering unrivaled accuracy, granularity and data governance. Our data is based on more than 2,000,000 cash flows from more than 107,000 PE-backed companies representing $40.5 trillion in asset value invested by close to 11k funds.

CEPRES pioneered the deal-level look-through for LPs, unlocking unprecedented deal-level benchmarking for the private markets industry. For nearly 20 years, CEPRES has built the largest, most secure and trusted data network between GPs and LPs. This network enables them to track fund and deal-level investment and portfolio company operations data, including revenue CAGR, entry/exit multiples/debt rates and hundreds more. CEPRES’s AI-based data governance and structuring procedures for asset-level data have made CEPRES the industry leader for deal-level data quality that our LP clients use to manage their portfolios’ assets. This data governance and quality is the basis for the industry’s largest aggregated deal-level benchmark universe with data on more than 100k deals, covering full cash flow information and operational data

CEPRES data is a core data backbone of the industry today and the driver behind many other specialized solutions that help transform the private markets to unleash their full potential.

Alka Banerjee

Global Head of Product, Market Data

The granularity of deal-level benchmarking is what sets it apart. Being able to drill down through aggregated portfolio returns to find out how the constituent parts are performing, the key deals driving growth, which value creation levers are paying dividends – it’s a whole new level of analysis. But deal-level granularity is only useful so long as it can be granular in other respects like industry, equity size, or investment year. That’s why DealEdge has focused on providing such a deep taxonomy, with over 560 subsectors: because more specificity is ultimately more actionability.

DealEdge, Bain & Company

At eFront®, a part of BlackRock, we believe performance benchmarking and risk analysis go hand in hand. Leveraging the data we source from LPs and GPs at the private fund and deal level, we have developed Insight Research, an analytical tool to help assess the performance and exposure within private markets, while also enabling peer group analysis of an investor’s own funds.

These capabilities feed into our Whole Portfolio Solution, which can give eFront® platform users a holistic view across both their public and private investments, as well as the ability to quantify common factors (among portfolio exposures), project cashflows, and assess performance.

Additionally, through our Insight Sustainability module, we enable clients to analyze financial and non-financial metrics in one place; our clients can manage and monitor their investments based on ESG risk incidents and scoring for private companies, as well as self-disclosed asset-level ESG metrics sourced from GPs, portfolio companies, public proxies, and more.

eFront, BlackRock

Hamilton Lane specializes in innovative and data-driven investment solutions. A key tenet of our investment philosophy is that superior investment performance can be driven by our superior access to data – which we derive from our scale, influence, and investment in technology.

We have invested in building Cobalt LP to put our information advantage directly into the hands not just of our investment teams, but also our clients. LPs desire access to advanced-level data and thinking, proprietary information, and insights that others don't have. Today we are monitoring over 60% of all private market capital around the world, leveraging our unique position and access point within the private markets.

Data is sourced directly from GPs through our portfolio monitoring service and also via our global investment team’s manager diligence process. Cobalt has what we believe to be the largest, most timely, and most accurate dataset in the industry. Benchmarks are available at the private market fund and deal level, and our clients have access to the same pre-investment data and research that Hamilton Lane investment teams review before allocating the $37bn in capital that we put to work last year in the private markets.*

Users can access deal-level benchmarking across standard performance (IRR, TVPI, etc.) as well as entry, current and exit multiples. Designed by industry experts, our solutions seek to empower limited partners to make investment and operational decisions with greater sophistication, precision, and insight.

Griff Norville

Managing Director at Hamilton Lane and Head of Cobalt LP

Effective benchmarking analysis requires access to a sizeable and credible dataset that offers comprehensive deal coverage and the ability to focus research on core performance metrics.

At Preqin, our asset-level benchmarks cover more than 55% of all-time buyout deals in North America and Europe. In addition, they offer core metrics such as deal-level returns, entry and exit valuation multiples, net leverage, fund loss ratios, and operating statistics. Our data is sourced directly from Schedules of Investments, and GP performance reports to LPs, which are processed, aggregated, and anonymized to provide benchmarking services.

We understand that access to asset-level data is crucial to investment decisions and is highly elusive in private markets. That's why we deliver the market's most accurate and granular asset-level benchmarks.

Jonathon Furer

Head of Limited Partners, Preqin

StepStone is a global private markets firm providing clients with customized investment solutions and data services. As one of the largest allocators of private market capital in the world (including more than $75b allocated in 2021 alone), StepStone has developed an informational advantage with unparalleled access to private market data.

Leveraging StepStone’s position in the private markets and the vast amount of data received across our technology platform through our proprietary research and due diligence system (SPI) and our reporting and portfolio management application (Omni), we have constructed an anonymized deal-level (i.e., portfolio company-level) private equity benchmark across strategies, industries, geographies, size ranges, and time periods. Access to the benchmark is available to all contributing GPs and LPs.

Unlike a traditional net-level benchmark, deal benchmarking looks at individual portfolio company returns without the impacts of fund-level economics including credit facilities, cash management, fees, and carried interest. Deal-level benchmarking enables more granular analysis (vs fund-level) to decompose the strengths and differentiators within a GP’s track record, as well as market trends.

Data is sourced directly from GPs and LPs and is updated quarterly, and as of June 30, 2022, includes more than 82,000 investments. The benchmarking analysis includes but is not limited to pooled and quartile metrics for TVM, IRR, DPI, and Loss Ratio by strategy, sub-strategy, and region; GICS sector and region performance by entry year; as well as Operating Metric benchmarking across purchase price multiples, leverage multiples, and equity contribution.

Additionally, StepStone provides non-performance-related benchmarks and analysis, including the preferred return, management fees, and GP commitments, in its benchmarking report.

StepStone Group

*The 2021 capital committed incudes all primary commitments that closed during the year 2021 for which Hamilton Lane retains a level of discretion as well as nondiscretionary advisory client commitments for which Hamilton Lane performed due diligence and made an investment recommendation. Direct Investments includes all discretionary and nondiscretionary advisory direct equity and direct credit investments that closed during 2021. Secondaries includes all discretionary and nondiscretionary advisory secondary investments with a signing date during 2021.

PROCUREMENT DOESN’T HAVE TO BE PAINFUL

We help LPs & GPs identify, qualify, and procure software, data, and technology solutions with our unique and comprehensive procurement as a service offering.

If you are thinking about your data and technology stack, we can help! Please leave your details below and we will be in touch.