As new benchmarking products showing returns at the deal level hit the market, PE Stack examines the key considerations for those considering adding private equity deal-benchmarking to their data and technology stacks.

Private Equity Middle Office Solutions Map – Portfolio Monitoring, LP Reporting, and Data

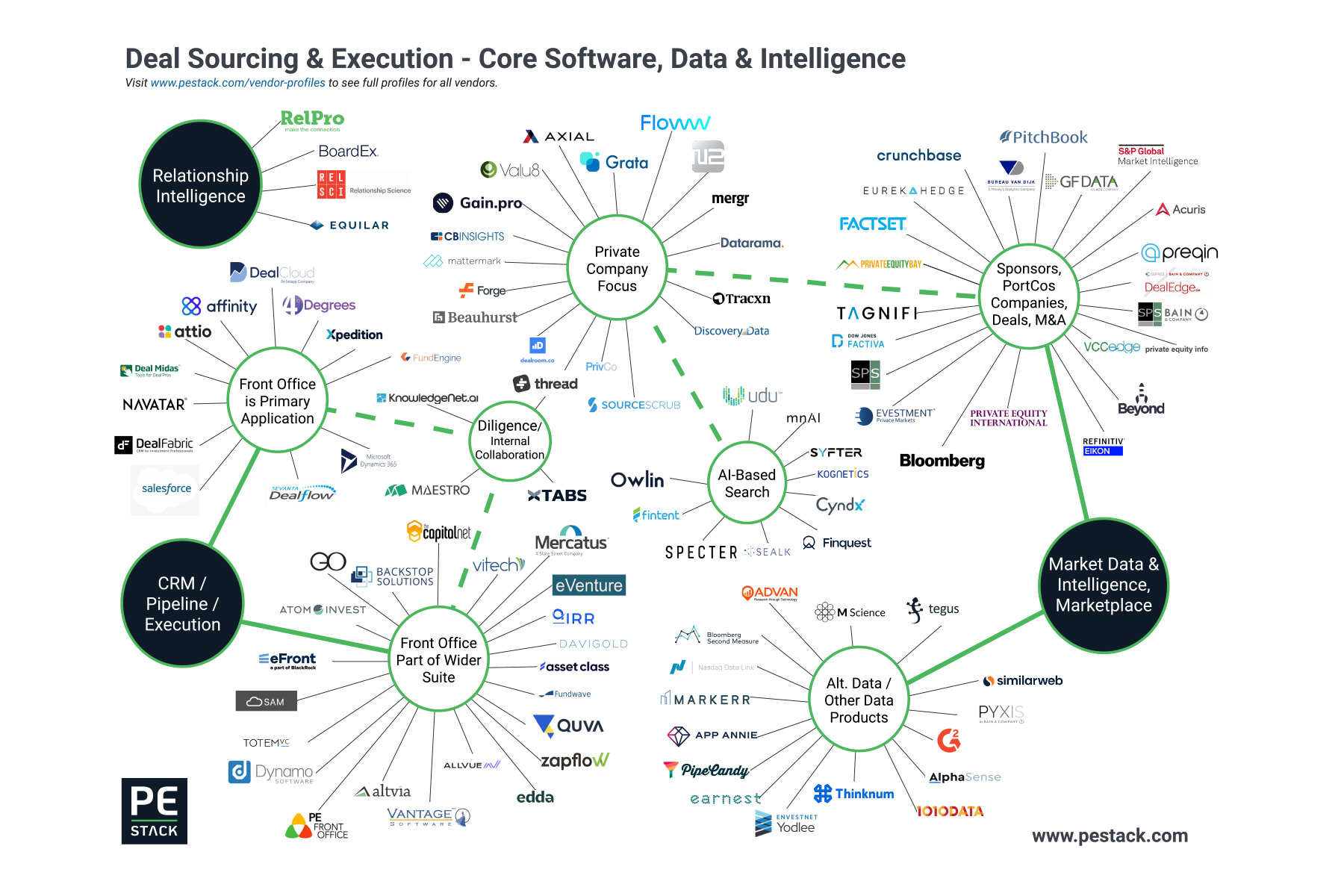

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

How are Private Equity and Venture Capital Tech Firms Funded?

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

S&P, Preqin and the Death of the Private Capital Silo

Preqin and S&P’s data partnership is the latest in a series of high-profile deals involving private capital specialists and broader financial data and software providers. We have some strong views on this emerging pattern and what it means for end-users, vendors and those doing deals in the financial data and technology industry.

Preqin Data Now Available on Factset Workstation

Preqin and Factset announce partnership which sees the integration of Preqin’s fund manager, allocator and performance data with the Factset Workstation.

Access to the new dataset is dependent upon Factset users also having the correct level of access to Preqin’s services. Existing dual-users can request access as of today (July 15th 2019), Factset users not currently subscribing to Preqin will be able to purchase access directly from Factset.

The addition of robust private markets data will add value for Factset’s M&A focused users, including investment banking and private equity deals teams. Preqin's data will help users to identify potential buyers and benefit from deeper intelligence on PE firms – for example, the ability to view the vintage and called-up % for a firm’s latest fund.

The data will also add value for Factset’s allocator clients, as Justin Strand, Factset’s Chief Content Officer and SVP, stated: “Investments in private equity are growing and clients require corresponding data to manage these investments effectively.”

"Factset appears within 26% of data and software stacks, making it one of the most utilized vendors in our sample"

PE Stack maintains comprehensive subscription and pricing intelligence for data and software products being utilized by 50 leading institutional allocators located in North America and Europe. Factset appears within 26% of these data and software stacks, making it one of the most utilized vendors in our sample.

Our analysis suggests that this new partnership will be well received by existing Preqin users - 75% of the major allocators tracked by PE Stack that have Preqin subscriptions also utilize Factset.

Of the other major data providers, Bloomberg is the clear leader in terms of allocator penetration with 73% of institutions tracked by PE Stack maintaining a subscription. In terms of aggregate subscription value, Factset is closer to matching Bloomberg as a result of a higher average subscription value from the institutions in our sample (which is more a function of client size rather than product cost).

"75% of allocators tracked by PE Stack that have Preqin subscriptions also utilize Factset"

Preqin and Factset feature alongside another 100+ vendors with profiles on PE Stack’s free Vendor Profiles platform, which helps private equity fund managers, allocators and service providers to identify potential software and data providers. To get instant access, please register here. For more information on our Allocator pricing and subscription data, please email info@pestack.com

eVestment Continues Data Expansion Drive with Preqin Integration

The growth of the private fund market is having a major impact on the dynamics of the software and data industry that supports it. For today’s allocators, there is enormous complexity in terms of the number of offerings to choose from and the breadth of strategies and industries being targeted. As the proportion of assets being placed in alternatives rises, the pressure to perform has never been higher.

Allocators, even those reliant upon consultants, are increasingly turning to software and data solutions to help them manage their programs effectively. We have seen a number of new products targeted toward this sector both from existing players expanding their offerings and start-ups seeking a foothold in a fast-growing market.

For me, eVestment has been one of the most interesting companies to track, and today sees the announcement of another data integration partnership to follow on from the recently announced deal with Pitchbook, with Preqin’s industry benchmarks make their way onto eVestment’s Private Markets product.

I feel that eVestment is taking a customer-centric approach to developing its suite of products, employing a willingness to work with widely-used datasets in order to increase existing clients’ satisfaction and better attract new users to its ecosystem. It’s a smart strategy.

Having a trusted source of market data is now an integral part of the portfolio management process for allocators serious about managing their programs effectively. Software solutions which do not facilitate the integration of trusted market data sources will increasingly find themselves at a disadvantage in an environment where this functionality is becoming more common. As I mentioned in an earlier article, users are also discerning when it comes to the quality of these integrations too.

It is encouraging to see software providers providing clients with multiple options when it comes to data integration. I have heard all the arguments about the relative strengths and weaknesses of the various databases and benchmarks, but the reality is that allocators need consistency. It is far easier to sell an allocator on an excellent analytics platform if they can immediately utilize the benchmarks which they are already using to track performance.

eVestment should be applauded for successfully taking a number of standalone products such as TopQ and Public Plan IQ and creating an interconnected suite of tools which is supported by high quality external data sources. The integration of Preqin data into the eVestment Private Markets platform reinforces eVestment’s commitment to giving their allocator clients exactly what they want and need to do their jobs effectively.

DealCloud and Preqin: What Makes Integration Powerful?

Market data integration is an increasingly important feature for CRM end-users; such partnerships are common in the industry with Preqin and other providers’ data available on a variety of platforms.

With DealCloud joining the list of partners for Preqin data, I want to take this opportunity to examine what makes for a best practice integration project.

“Data Integration is not just a box ticking exercise”

I seriously question whether the people who developed my car’s terrible Bluetooth integration have ever used a cellular phone or operated a motor vehicle. It takes a good 30 seconds to activate, fails to show the name of anything other than the first track I play on Spotify and will sporadically disconnect for no reason. Incoming calls require the pressing of multiple buttons as I urge the caller to be patient and not hang up. Conversely, my wife’s car connects instantly, shows album covers while playing music, and deals with calls flawlessly.

When it comes to integration, not all developments are equal. To avoid frustration down the line, here are some of the key things to look for when assessing the quality of this vital feature:

What is powering the integration?

There are two ways in which data can be pulled into a platform. API integration is best practice, pulling data directly from the source in real time. The alternative is a periodic data dump which can sometimes be easier to develop from a technical perspective, but can be inferior in terms of the timeliness of data if not refreshed often. This might not sound like such a big deal, but for data sets where news can dictate activity it can make a significant difference. For example, a live or near-live feed of Preqin’s LP news can help fundraisers to react quickly to relevant updates which might otherwise be missed with a weekly or monthly refresh.

What data and functionality is being included?

Preqin, Pitchbook and other market data providers maintain numerous datasets, encompassing LPs, GPs, fundraising, performance, deals and more. When considering a CRM, examine the breadth of integration with your favored data provider and the depth of data. A good integration would not see you switching back and forth between platforms due to insufficient detail being carried across. Another related factor is functionality - does the integration allow for the discovery of previously unknown entities via a search on the CRM platform?

What are the subscription terms?

Data providers will often encourage existing clients to add more users, providing added value which is subsequently captured through increased fees. This can naturally cause conflict with CRM integration if there is any chance of a client gaining increased access without paying for it. I don’t see fees around integration as a bad thing if additional value is being offered, but make sure you know what the financial implications of an integration will be as you consider your overall budget and spend. Don’t assume that your single-user data license will translate into an enterprise-wide access via integration on the CRM side.

How is the UX?

I’ve seen a lot of integrations, some are integrated seamlessly into the workflow and work extremely well. I’ve seen some very clunky solutions which, like my car’s Bluetooth, don’t. A key part of the user experience will be how the integration deals with duplication and information asymmetry. You may know more than the data provider about an individual or entity. How is such disparity dealt with on the CRM side? Is there a single sign on process? Will the integration work on mobile? The better the UX, the more the data will be used and the more value it will add.

DealCloud and Preqin

The key point to take is that integration is not a box-ticking exercise and users should examine the quality of this important feature when assessing their providers. Different users will have different priorities, but the integration offered by DealCloud and Preqin appears to be a high-quality, thoughtful development. Data is being refreshed regularly from the live database which is a big plus, the breadth of data on LPs is significant and the functionality on the front end has been carefully considered with involvement from both the Preqin and DealCloud development teams based on feedback from mutual clients.

DealCloud is one of the names I hear most commonly when discussing CRM and is one of the fastest-growing platforms available today. Combined with Preqin’s data, which is especially strong for fundraising and fund investment purposes, this makes for a compelling front office solution.