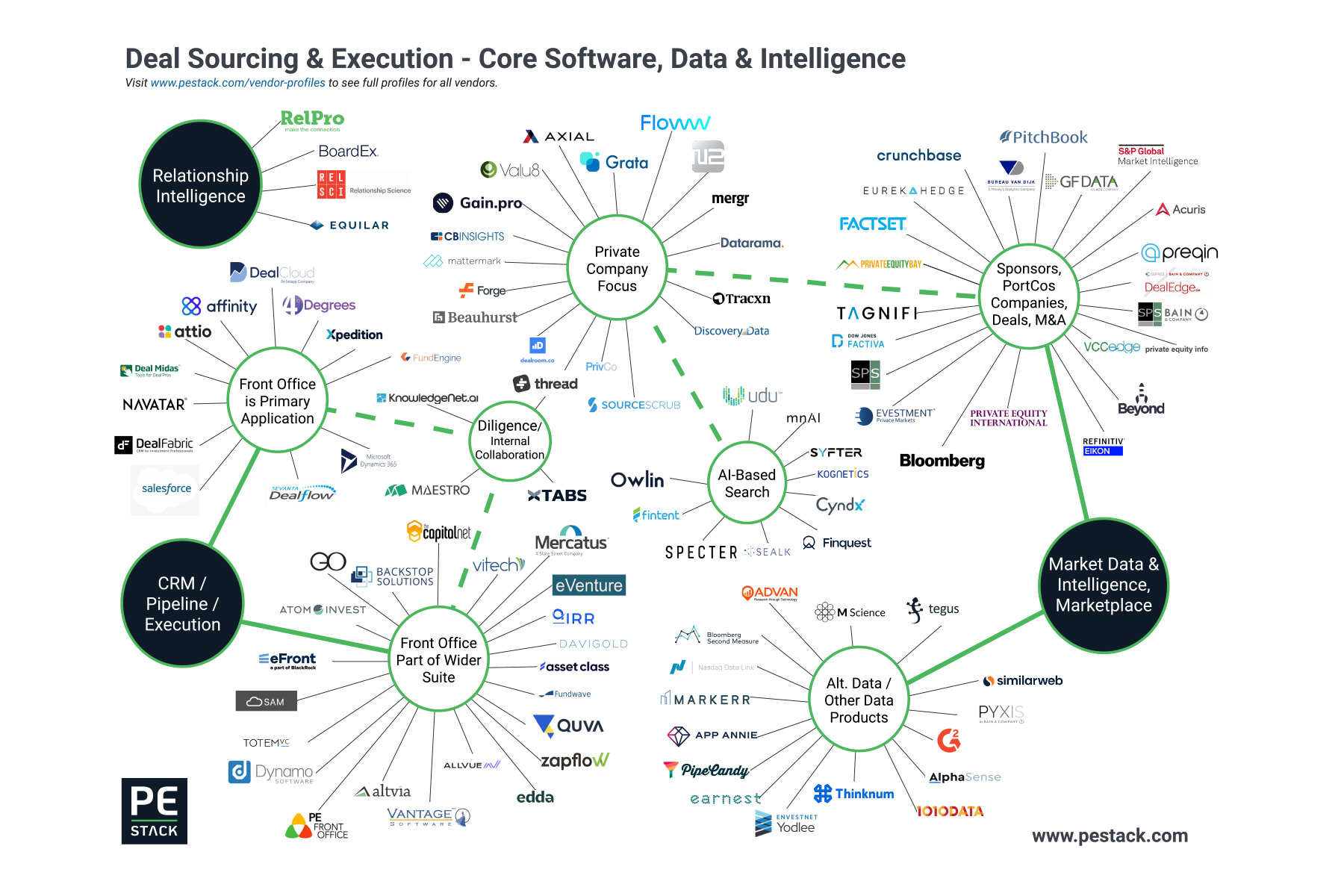

PE Stack's solutions map shows all private equity and venture capital specialized technology, software and data vendors providing services in the CRM and wider front office space alongside concise descriptions of the different technologies being used in this area.

The Dynamo Effect: Imagineer The Latest Major Acquisition For Francisco-Backed Vendor

Solovis and Imagineer Activate Collaboration

Two prominent names in the alternatives software world are announcing a new partnership combining the quantitative strengths of the Solovis Platform with the qualitative tools of Imagineer’s Synap.

When it comes to tools for allocators, the most powerful applications are those which most closely align with the workflow of today’s professional investor. Maintaining an allocation to private equity and other alternatives is a process which incorporates multiple factors:

quantitative and qualitative due diligence on new managers

effective monitoring of existing portfolio including risk and exposure factors

research on the wider market and environment

The newly announced collaboration between Solovis and Imagineer will allow for the qualitative side of the portfolio management process to be integrated within the more quantitatively focused Solovis platform, which includes tools enabling investors to manage complex multi-asset portfolios with advanced data collection and standardization, reporting and analytics functionality.

Partnerships like this can be challenging to get right from the strategic business perspective, but if both partners have a shared vision and similar goals, it can be an effective strategy to quickly create a single platform with tools which are tried and tested. Given the complexity in developing such functionality from scratch, the approach taken here can lead to a better end product more quickly and less riskily when compared with either firm developing similar products from scratch.

I feel that the strengths of Imagineer and Solovis are complementary in nature and this collaboration makes a great deal of sense. It will allow both Solovis and Imagineer to gain exposure to new customer-bases and provide additional value to mutual clients.

We know that shifting between multiple platforms to complete tasks can be inefficient and adds risk to any process. Today’s LPs and GPs are operating in an environment which is increasingly complex with allocators in particular facing more choice than ever in terms of funds on the road and the strategies they are employing. Whether through partnerships, acquisitions or new developments, effective integration of complementary tools with a single source of data is increasingly important to the modern institutional investor.

Here is the link to the official release