As Preqin announces the acquisition of Colmore, PE Stack takes a look at the deal and how the stated strategy compares to other integrated market data and SaaS solutions in the competitive LP-focused solutions space.

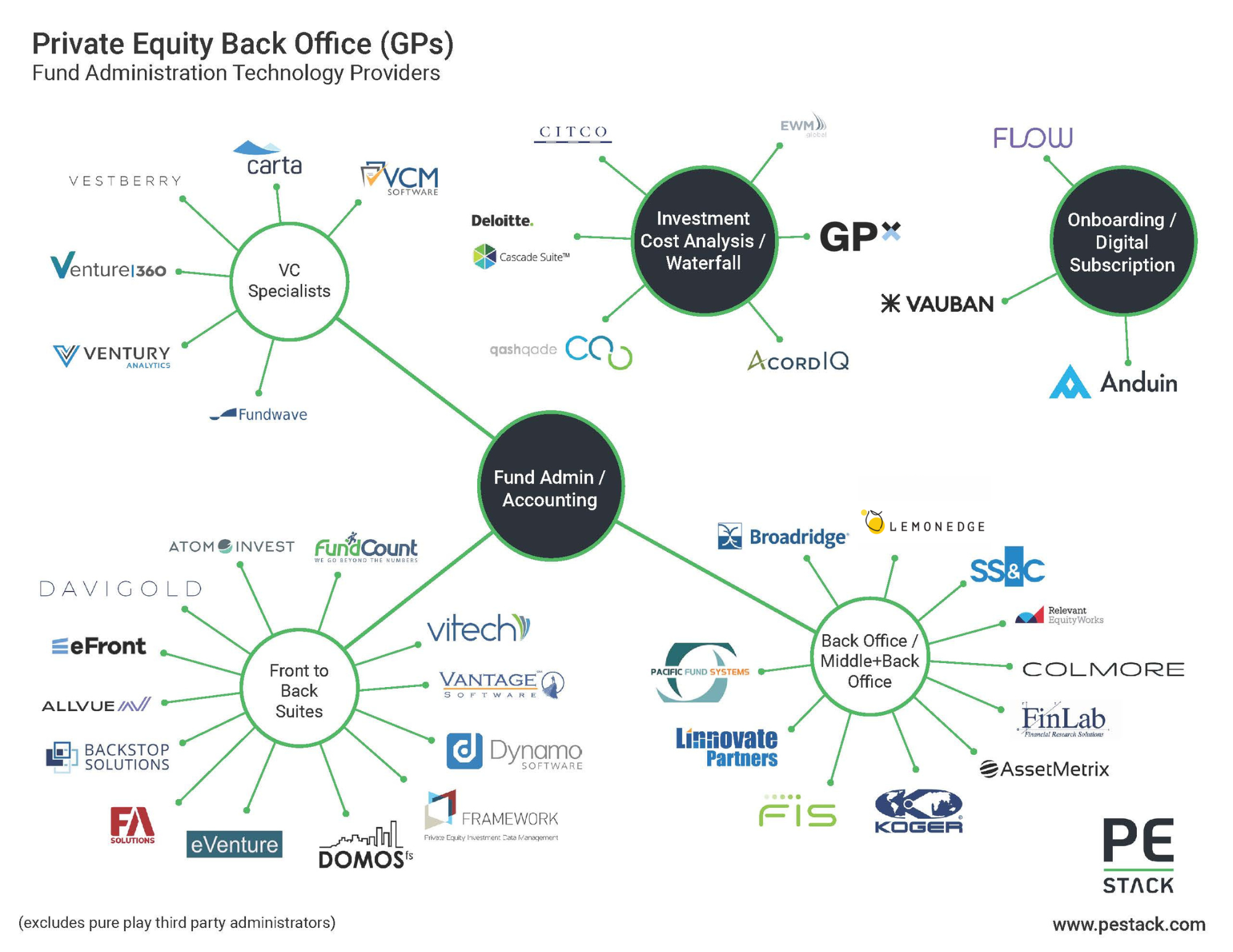

Private Equity Back Office Solutions Map - Fund Administration Technology, Waterfall Calculation, Subscription and Onboarding

Private Equity Middle Office Solutions Map – Portfolio Monitoring, LP Reporting, and Data

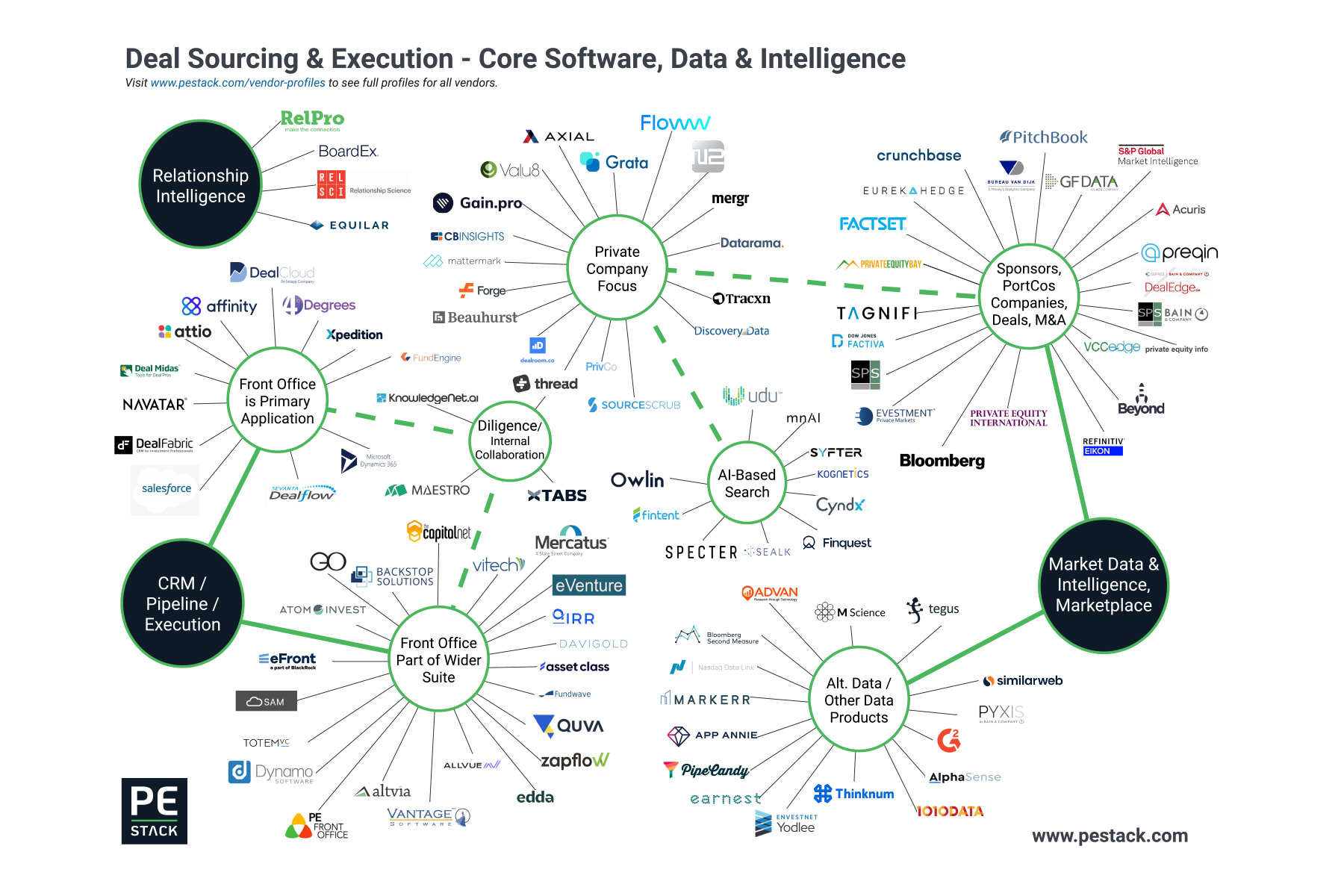

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

How are Private Equity and Venture Capital Tech Firms Funded?

The Great Data and Analytics Race

The past week saw the announcement of two new partnerships as consultants to both the buy and sell-side seek to better serve their clients in the illiquid markets.

CEPRES, a provider of analytics and data exchange for private equity and other illiquid asset classes, announced this week it had formed a partnership which will allow Bain & Co to access insights and tools which promise to deliver ‘new levels of value’ for its private equity GP clients.

In other news, leading custodian BNP Paribas took a strategic stake in AssetMetrix, allowing it to expand and digitize its services to clients and investors through the provision of analytics and reporting tools dedicated to the analysis of private capital asset classes.

These two new partnerships mark the continuation of a trend where consultants and custodians are making moves to better serve a client base which is crying out for more robust reporting and analytical tools.

Another notable deal in September saw multi-asset class portfolio monitoring specialist Solovis partner with State Street to facilitate improvements to the Powered by DataGX product. And of course, Blackrock’s acquisition of eFront opens up opportunities for products which encompass entire investment portfolios. Other notable firms in the space such as Burgiss, which recently unveiled a new and improved UI, also maintain important custodian relationships.

What is fueling this trend?

The term ‘alternative’ assets is looking increasingly outdated as institutional investor allocations to private capital asset classes rise and grow in sophistication. With more products to choose from in more areas, and with more means of accessing investments (funds, direct, co-investments, separate accounts etc), there is an increasing demand for high-quality data and analytics as allocators seek to more effectively monitor and manage their portfolios.

This demand is also extending to firms advising and managing assets, and could prove to be a key factor in this already competitive market.

What are the Key Features?

Products in this area pack a lot of functionality into their platforms, but there are some key areas which can act as real differentiators:

Data Ingestion

In order to provide robust analytics, investment data must be entered into the platform in a timely and accurate manner – an activity made challenging due to inconsistent (and in some cases outdated) reporting standards. Providers in this space such as Chronograph are increasingly using the latest technology to automate elements of the ingestion process, while many offer analyst services to manage the process on behalf of clients.

It is likely that both pressure from LPs and groups such as the ADS Initiative will result in higher quality, more standardized reporting from GPs, making this piece of the puzzle less of a headache in years to come.

Data and Analytics

Here’s where things get really interesting. There are really three main types of data at play in the industry today:

User Data: which is completely transparent and granular at both the fund and portfolio company level

Benchmarked User Data: which lacks transparency, but is granular at both fund and portfolio levels.

Market Data: which is completely transparent, but lacks granularity especially at the portfolio company level.

Platforms in the industry today have a mix of these three elements forming the basis of the data layer which power the analytics, and each has an essential part to play:

User data is the core piece, showing the user how they are performing over time, helping to illuminate exposure to different industries and geographies, facilitating cash flow modeling, VaR and much more.

Benchmarked user data aggregates client data to produce granular, anonymized benchmarks based on large datasets. These benchmarks, such as those produced by Burgiss and CEPRES, are robust in that they do not suffer from survivorship or reporting bias and offer a level of granularity which transparent market data providers cannot match.

Market data providers (such as Pitchbook and Preqin), while not as granular, are necessary to show how specific firms have performed and form an important component of the fund discovery and due diligence piece which is so important in today’s complex marketplace.

Pressure is growing on technology providers to utilize all three areas effectively. We are also seeing the emergence of a fourth piece, which is the voluntary, case-by-case provision of portfolio company-level granularity to non-investors over a platform to facilitate fund discovery as GPs take a more long-term approach to capital raising.

Winners in this space will be those that manage the relationships, partnerships and technology required to bring these data elements together, layering analytics to facilitate deep understanding for their users. Add in fund discovery functionality and the ability to conduct both primary and secondary transactions and you have the making of a truly ‘killer app’ for the private capital markets.

Please visit PE Stack’s Vendor Profiles to see more information on all the companies mentioned in this piece and over 100 more!

LP Portals: The Most Important Investor Relations Tool?

Investor Reporting Software

The needs and requirements of private equity and venture capital LPs are evolving. While the personal relationships which historically underpinned a firm's ability to attract and retain LPs remain important, the asset class' increasing size and complexity is putting more pressure on LPs to maintain a robust portfolio based on frequent and high-quality analysis of existing and potential new GPs.

Managers coming to market today will experience a fundraising market unprecedented in terms of competition where providing access to high quality reporting tools and data on demand can make the difference in achieving a fundraising goal. It is essential for fund managers to align with LP demands for high quality reporting, and we believe that the choice is no longer whether or not to implement an LP Portal, but which one will most effectively serve to enhance a GP's brand among existing and potential new LPs.

What Makes for a Good Portal?

The LP Portal is often the primary means for investors to interact with a fund and therefore plays a big role in brand-perception. Many of the leading solutions will allow for a firm to brand the portal in their image, including eFront's Investment Café which facilitates customization to reinforce a firm's style and image. A good UI (user interface) is essential so the LP can find the information they are looking for and enter their own data easily.

The best LP portals will include data visualization, access via mobile devices and the ability to produce high quality reports for investors. Certain platforms, including Cobalt, feature native third-party data integrations to allow for the production and distribution of benchmarking reports.

As fund information is sensitive, the portal needs to be very secure. In fact, one of the best reasons to use a portal is due to potential issues with mail and email, both in terms of preparation and delivery. Products such as Altvia's Sharesecure are now utilizing enterprise-grade features such as two-factor authorization and virus scanning to ensure compliance and maintain security. Dynamic watermark creation is another feature which not only lowers the possibility of human error, but also saves IR professionals days of time over the course of a fund.

The trend among LPs from large pension plans to nimble family offices is for increasing demand for up- to-date, granular data about the fund's portfolio, prospective deals, cash flow and benchmarks. In addition, information related to sources of investor alpha, compliance and risk should be provided and forms a major part of offerings from firms such as LP Analyst. Firms seeking a solution designed primarily around facilitating due diligence can leverage tools such as eVestment's TopQ. Both LPs and GPs will appreciate the more prosaic aspects of a quality portal such as an easier and more secure transmission of their annual K1s along with the ability to upload changes in their address and banking information.

It all adds up to better customer service, brand building and relationship cultivation while leaving investor relations professionals with more time to engage in value-added activities instead of menial tasks. Certain platforms, such as Capital Dynamics spin-off Colmore, also offer outsourced investor reporting in addition to a quality portal which can further enhance the LP experience in a cost-effective manner.

Standalone vs. Suite?

One of the most common questions we hear at PE Stack is whether to build a collection of standalone applications, or select a single suite of services from one of the primary software suppliers, the majority of which offer portals. While each procurement process is different, there are some clear benefits to using a platform such as AltaReturn which offers users the ability to integrate back and front office tools with its investor portal.

PE Stack

Our Vendor Profiles platform tracks over 150 software and data vendors, including more than 30 which offer an LP portal. We help GPs, LPs and service providers to identify potential solutions via our free to use, powerful online database and by providing bespoke consulting services. For instant access, please visit www.pestack.com/vendor-profiles or email us at info@pestack.com