Part I: Front office solutions map for GPs

Part II: Middle office solutions map for LPs & GPs

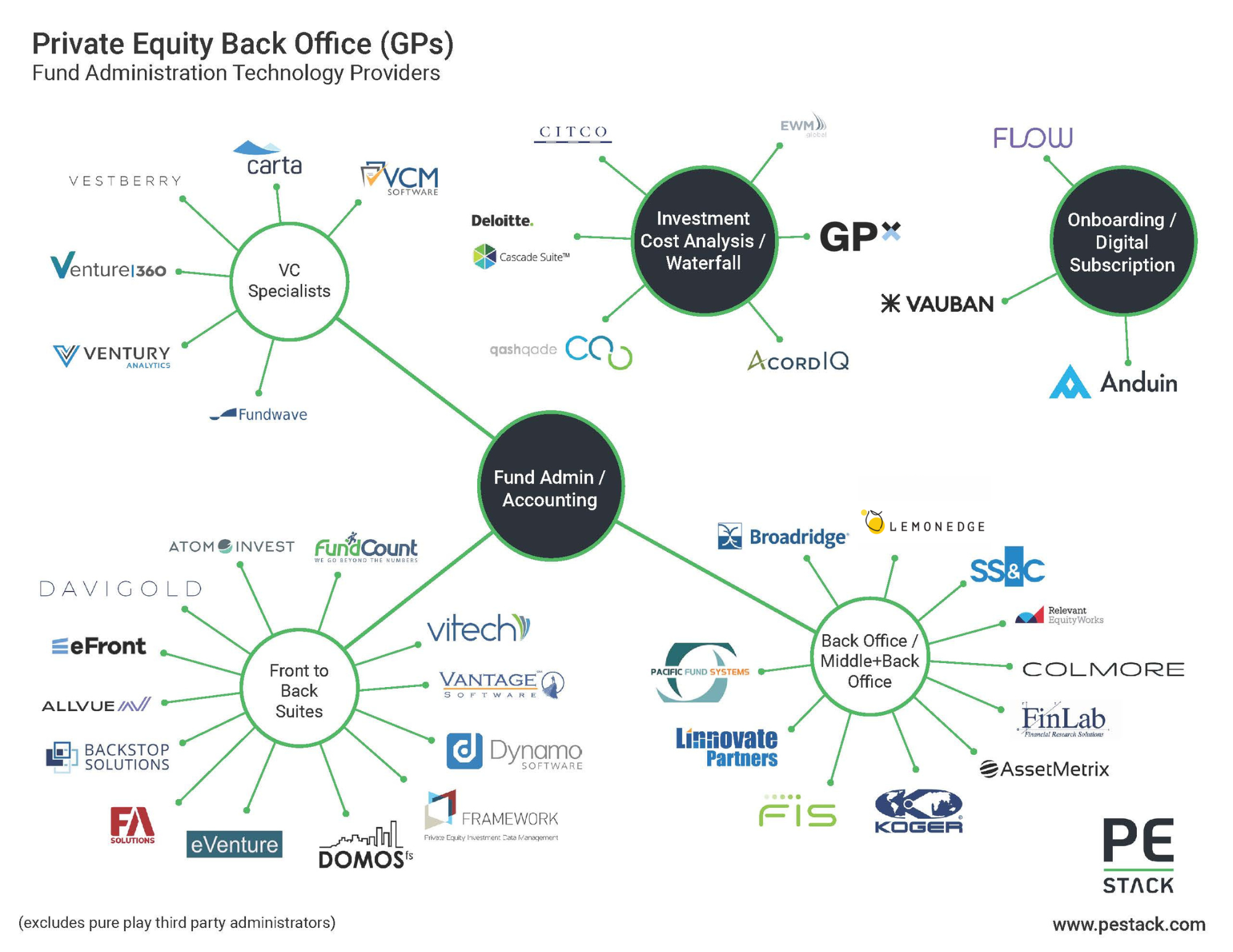

Part III: Back office solutions map for GPs

Private Equity Back Office Solutions

Vendor Reputation, Third Party Administrators and the Perception of Risk

Unlike other areas covered by PE Stack, the back office is often outsourced to third party administrators, many of which will use some of the platforms outlined in our map to deliver services to their clients. FIS Private Equity Suite (formerly known as Investran), eFront and Allvue (encompassing the company formerly known as AltaReturn) are all prominent names for outsourced service providers.

The dominance of these firms in the TPA space highlights one of the key trends we see for back office product selection - the importance of brand, experience and track record. Given the fundamental importance of back office administration to the fund, these factors are often deemed as especially important during the procurement process.

Administration is also an area likely to be highlighted by limited partners when considering investment in an emerging manager. We often hear of cornerstone investor commitments being contingent on the use of an established back office platform and fund administrator - we have even seen cases of LPs specifying the administrator to be used. For them, ensuring the backbone of the fund is setup effectively is a key area of risk mitigation.

Innovation and Specialization Key Tools for New Entrants

The perceived importance of brand, experience and reputation alongside the sticky nature of back office products has made it more challenging for newer entrants in the space to achieve market share when compared with other areas tracked by PE Stack. That said, there are some innovative new products launched in recent years which have carved out market share through specialization or innovation.

Within the venture capital space, we see a number of products setup to effectively serve some of the unique requirements of this community, such as complex valuation calculation and cap table management. Some firms, such as Carta, are offering a hybrid technology and service offering designed specifically for VC and VC-backed companies. VCM Software has a powerful valuation module which is able to account for complex scenarios such as the presence of warrants when calculating the price of assets - a timely function given regulatory challenges from the Cayman Islands and other jurisdictions.

We have seen a number of new players such as Qashqade entering the market with products designed to digitize the management of fund costs / waterfall distribution calculations while also serving as a fee validation engine from the LP perspective. These calculations tend to be one of the more complex areas of fund administration, an area which has until recently been the domain of Excel spreadsheets, even for firms which are using SaaS products in other areas of their organization. Given the tales we hear regarding the frequency with which errors occur when calculating fees, the presence of such products is welcome as a means to ensure accuracy in addition to achieving increased efficiency.

Of growing interest is the area of digital onboarding and subscription. We are aware of other companies which offer services in this area, but here we highlight some of the firms which are aiming to streamline some of the menial and arduous tasks facing private equity firms specifically. Examples of firms in this space include Anduin which has a solution to digitize the previously inefficient process of onboarding LPs, and Vauban which has created an innovative solution for the establishment of SPVs and other legal entities for private equity and venture capital firms.

The presence of no and low-code functionality has been a growing trend within the wider PE software ecosystem over the past couple of years. Lemontree Software is the first to launch a solution of this nature with specific application for the private equity back office. The firm’s strategy of allowing users to export and own the code from its platform is both a measure of its confidence in customers’ ongoing perception of value in the product, plus an innovative approach to solving the vendor risk perception which can accompany new entrants in the back office space specifically.

Front to Back, Back to Front

As vendors in the space have grown, it has been very common to see firms achieve revenue growth through providing existing clients with additional products and services. Through a mix of organic development and acquisition, firms such as Dynamo and Backstop have expanded toward the back office and sought to provide additional value to their considerable userbases through providing additional modules. We have seen a similar approach from firms previously specializing in back office moving toward the front. Certain firms such as AltaReturn/Allvue and Atominvest have built full suites from the ground up, an approach which can lead to consistency in terms of look, feel and inter-module data flow.

While we believe every element of a GP or LP’s tech stack should be reviewed on individual merit, there are natural advantages to using a suite of services, such as the added simplicity of maintaining fewer relationships and the presence (assuming modules are properly integrated) of consistent underlying data.

Technology as a Differentiator for TPAs?

As we look to the future, one trend which we expect to continue is the growing importance of technology as a differentiator for third party administrators seeking to increase market share in a competitive market. The rapid growth of new firms such as Linnovate Partners, which has designed and built a hybrid technology/service model from the ground up, is evidence of the market’s demand for quality technology as part of a service agreement.

We also expect to see additional in-house development of tools from traditional administrators, more partnerships between service providers and technology providers, and the acquisition of technology vendors - including in the middle office space. We also hear of PE firms seeking to maintain closer control of their technology by owning the software which the administrator is using. While we would highlight the potential for issues to arise from such a situation, if this were to become more common it would certainly have the potential to change certain dynamics in the market, including placing additional expectations on service providers, software vendors and implementation specialists alike.

Thinking about back office?

We can help. We understand private equity workflows and how specialized technology fits into the wider infrastructure, allowing LPs and GPs to conduct a comprehensive and efficient procurement process.