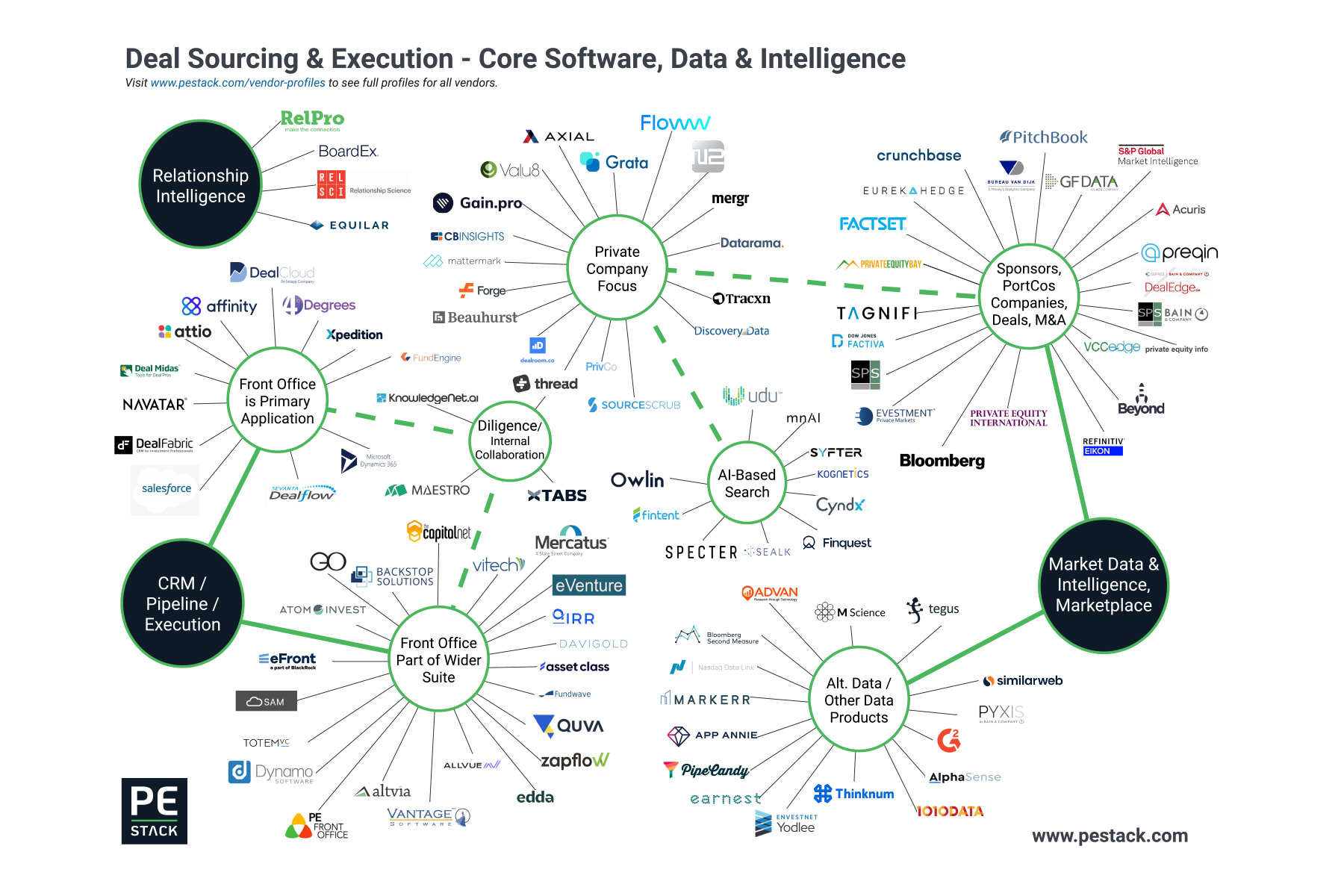

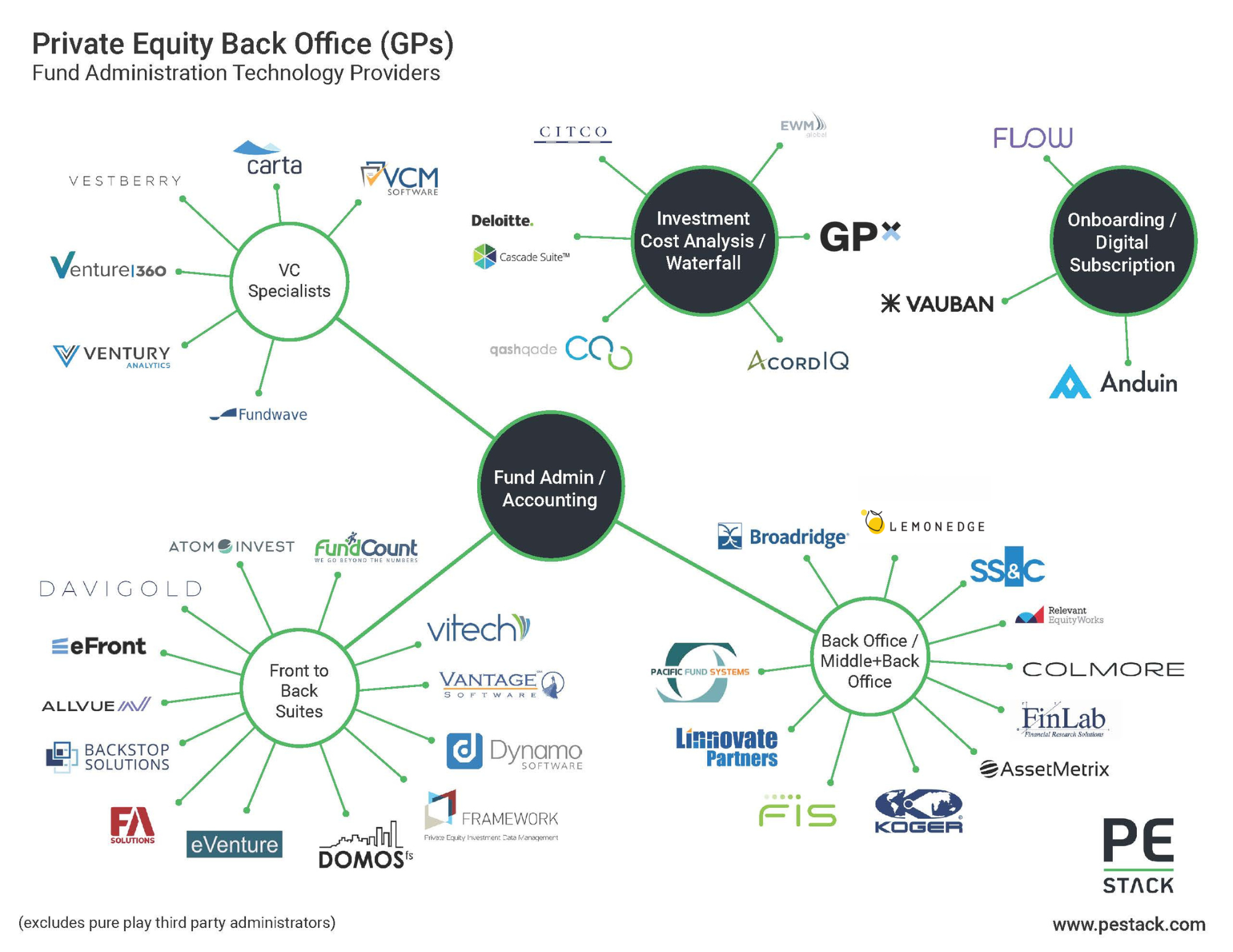

PE Stack's solutions map shows private equity and venture capital specialized technology, software and data vendors providing services in the back office space and discusses trends, innovation and risk perception in this area.

Fair Valuation: Urgent Considerations for VCs

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

Digital Waterfalls

Waterfall calculations are notoriously tricky - even firms with high quality technology stacks find themselves reverting to Excel when calculating distributions. Has qashqade solved this problem with its focused ccc product?

Waterfall calculations are tricky enough that some of the major back-office solutions don’t even attempt to offer functionality in this area. The platforms that do are often limited in terms of their flexibility and accuracy. For the most part, Excel remains the popular tool in this area – a problematic scenario. Aside from the high potential for human error and lack of audit trail, it is surprisingly common to see ‘small’ or sometimes big differences between the terms of the LPA and the basis for calculation in Microsoft. There has to be a better way…

This week I spoke with Oliver Freigang, Co-founder of qashqade, and had the opportunity to take a look at the software he and his team have built. qashqade is a powerful platform built specifically to facilitate the calculation of waterfall distributions including highly complex calculations and the respective carried interest allocation. A relative newcomer to the private equity fintech space, qashqade gives users the ability to configure their setup to any conceivable level of granularity. In addition to offering more accountability and security, it also facilitates experimentation and the ability to model the economic impact of proposed terms and conditions in real time.

With fund terms facing intense scrutiny amid an intensely competitive fundraising market, qashqade can provide a boost to fund marketing efforts and is sure to be appreciated by allocators seeking transparency and understanding of an area than can make a material impact on overall returns. The platform is also likely to be appreciated by GP employees, who can see reports and results on their personal distributions.

Having experienced the product, I can vouch for its customizability, flexibility and ease of use. Since its launch in 2018, this product has gained good traction in Europe from PE and VC firms, auditors and administrators. It also has applications for start-ups.

If you’re interested in streamlining your waterfall calculation process, I recommend taking a look.