Nasdaq Private Market Push

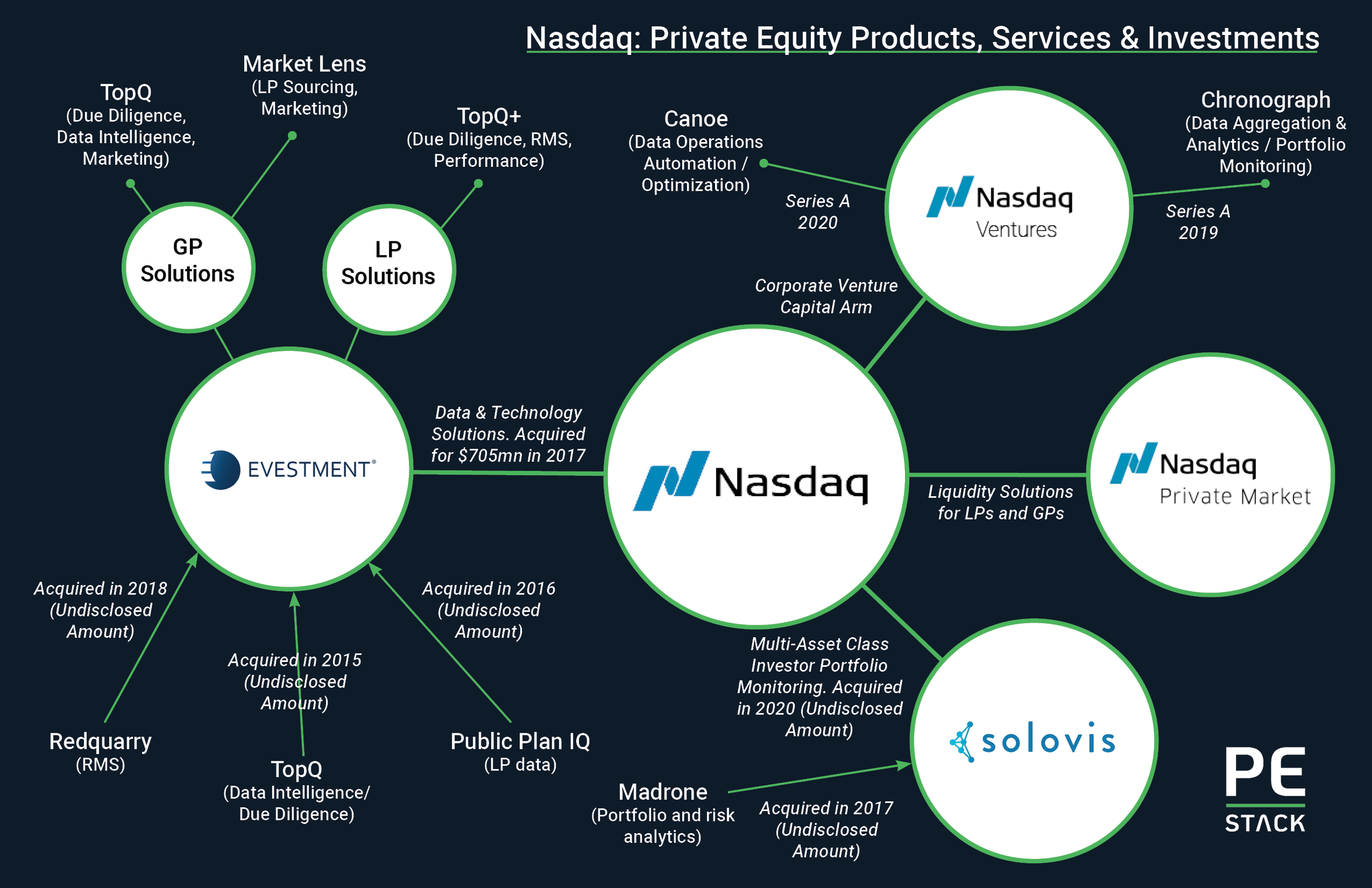

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent acquisition of leading multi-asset class portfolio monitoring platform Solovis and investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

Nasdaq’s activity in the private equity space includes data and technology products via eVestment and Solovis, venture stage investments via its corporate venture capital arm, and innovative liquidity solutions for alternative investments via Nasdaq Private Market.

eVestment

Nasdaq’s $705mm acquisition of eVestment in 2017 provided access to a platform known for high quality public and private market data. Before Nasdaq took ownership, eVestment had itself undertaken a number of acquisitions: Pertrac in 2012 boosted its hedge fund analytics capability, while a deal for the private equity focused due-diligence platform TopQ followed in 2015. The acquisition of Public Plan IQ in 2016 provided users with access to deep data to help with marketing and understanding public institutional investors in the UK, US and Canada. Most recently, the acquisition of Redquarry added RMS functionality to the growing portfolio of tools within the eVestment wrapper.

If you visit the eVestment website today, there is virtually no mention of these individual products, as the firm has worked hard to integrate functionality and provide additional value from its different tools working together in the eVestment Private Markets division. It is perhaps easiest to consider eVestment’s position with the PE data and technology space in terms of what it can offer its clients: GPs use the Market Lens and TopQ platforms to add value to data management and intelligence, fund marketing and LP sourcing activities, while LPs can conduct due diligence, manage research processes and compare manager performance with TopQ+.

Solovis

Prior to its acquisition by Nasdaq, Solovis’ innovative multi-asset class platform experienced significant growth since launching in 2013, quickly emerging as a leading name in the institutional investor portfolio monitoring and analytics space. The firm received investment from a number of prominent VCs: Edison Partners, MissionOG, Timberline, OCA Ventures, FINTOP Capital and Cultivation Ventures. Also backing the firm was Northwestern University and Jeremie Bacon, co-founder of Backstop Solutions.

Solovis was a pioneer in the multi-asset class space, offering an alternative to maintaining multiple platforms for different asset classes. In addition to the added efficiency of maintaining a single platform, Solovis’ users are able to access deeper understanding across their entire portfolio of investments, including: exposure, risk, liquidity and cash flow forecasting. To supplement its internal product development Solovis acquired Madrone, a provider of portfolio and risk analytics, in late 2017.

Nasdaq Ventures

One of the more notable trends in private capital technology in recent years has been the growth of solutions designed to help LPs and GPs manage and analyze investment data. Through its Nasdaq Ventures investment arm, the company has exposure to this important area through an investment in Chronograph, one of the fastest growing data and analytics platforms in the industry.

Nasdaq Ventures’ most recent investment is in a company called Canoe, a platform dedicated to optimizing private capital data – LPs can use the platform to increase the actionability of a variety of investment data, including from unstructured sources and PDF reports.

While Nasdaq Ventures continues to make investments in a wide swath of fintech companies around the world, it will be interesting to see what opportunities arise to further advance the technologies that help serve the wider private equity community, and potentially complement the eVestment portfolio.

What is missing?

On eVestment Private Markets, LPs have access to a subset of fund performance data from PitchBook via a recent partnership, PitchBook and Preqin Benchmarks, and also can leverage data that is directly contributed by GPs on the eVestment platform. The approach required to maintain a database of private equity data is somewhat different to other asset classes, making it challenging even for data-focused businesses to enter and compete in this market.

It will be interesting to see eVestment’s progress building a data ecosystem that combines contributory and vendor data to support manager discovery and due diligence. The acquisition of Solovis raises some interesting possibilities here too, potentially allowing for aggregated benchmarks based on underlying client data if the firm is able to adopt a similar approach to products such as the Burgiss Manager Universe. The ability to accelerate manager-contributed data is another potential synergy.

In terms of software use-cases, Nasdaq’s offerings and portfolio companies compete against products which, as part of a wider suite, offer additional functionality for back and front office tasks on the GP side. Given the importance of robust front office tools within the fundraising/investor relations space where eVestment’s Market Lens is a popular solution, expansion in this area would be logical; as would an expansion of LP data beyond the public plan intelligence currently on offer.

Looking Ahead

While the various products and investments are not completely integrated under one platform, the portfolio of functionality which Nasdaq holds looks compelling, both in terms of the quality of products and the range of both LP and GP functions which they satisfy. The addition of Solovis in particular offers many possibilities - including the ability to manage and potentially integrate pre and post investment activity alongside portfolio monitoring.

We constantly hear of increasing complexity as the asset class’s monumental growth shows little sign of slowing down. Investors will require higher quality market data, deeper and more timely data around existing investments plus powerful analytics to help them make sense of the landscape. For GPs, not only will they need similar tools for their own understanding, but also need to ensure they are able to satisfy demand from new and existing LPs. Nasdaq’s suite already goes a long way to satisfying both use cases, and we expect to see further functionality as a result of tighter product integration, organic development and acquisition in future.

It will also be interesting to see how increased focus on data and tools helps to support Nasdaq Private Market’s innovative fund products, both in terms of data flowing into the platform and the potential for data generated by areas such as secondaries to be incorporated into eVestment for additional insight.

Given Nasdaq’s wider experience and focus, it may even be possible to leverage its growing product suite and client base to offer a true marketplace and fund discovery platform for the private capital markets which facilitates both primary and secondary transactions with all of the tools and data required for robust decision-making. Click on the images below to learn more about Nasdaq’s private markets solutions through PE Stack’s Vendor Profiles database!

(This article was originally posted on February 21st and was updated March 10th to reflect the Solovis acquisition)