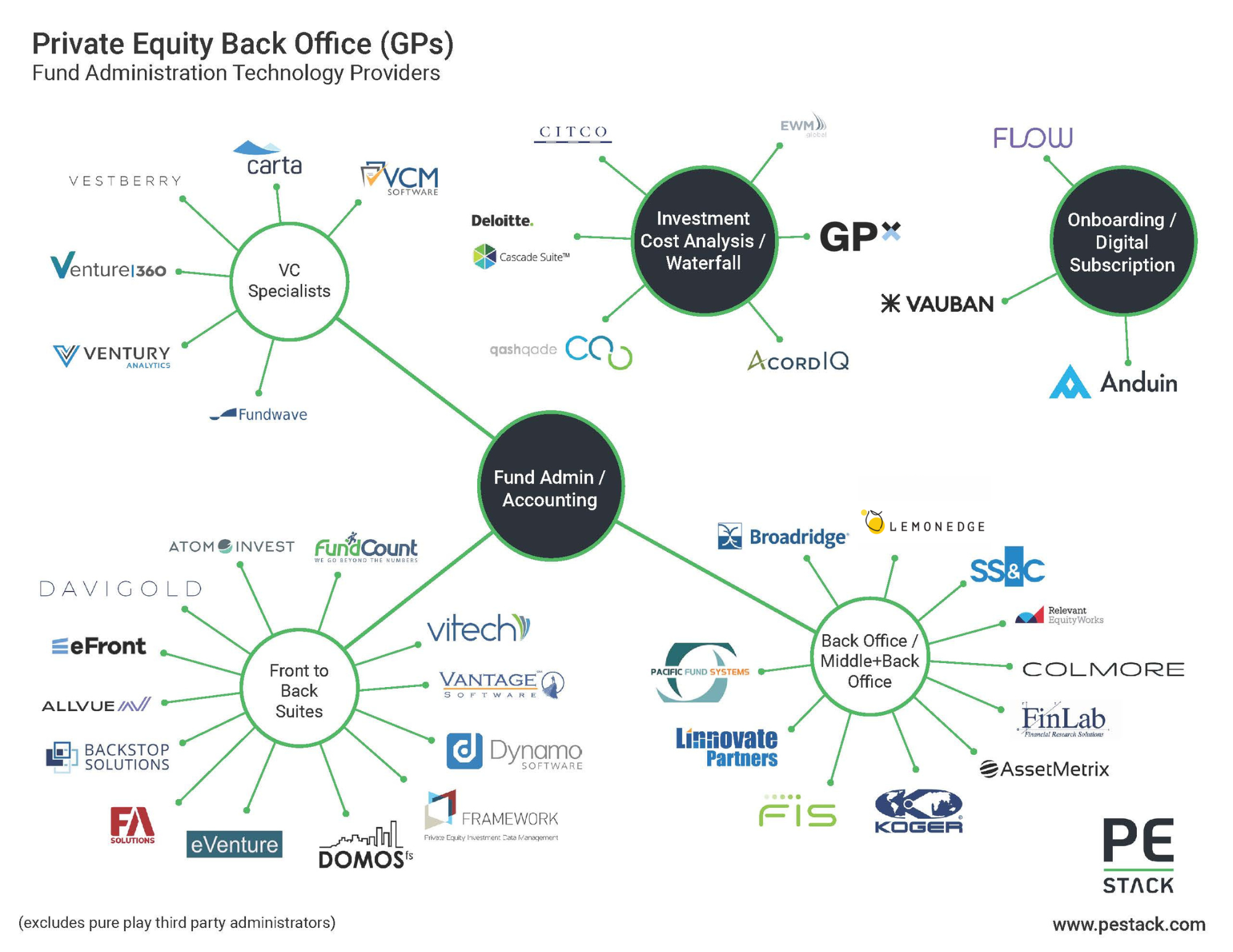

PE Stack's solutions map shows private equity and venture capital specialized technology, software and data vendors providing services in the back office space and discusses trends, innovation and risk perception in this area.

Private Equity Middle Office Solutions Map – Portfolio Monitoring, LP Reporting, and Data

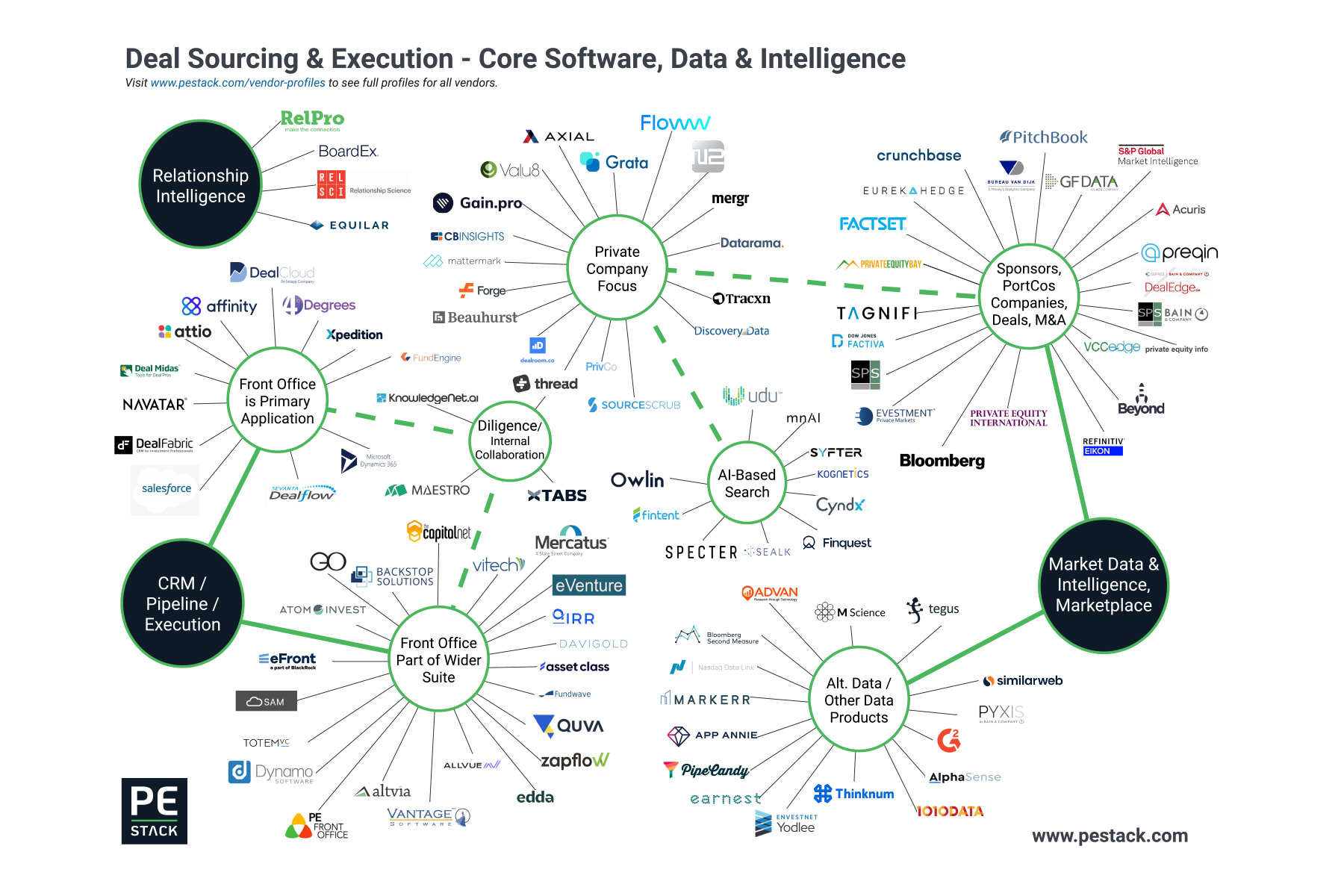

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

The Dynamo Effect: Imagineer The Latest Major Acquisition For Francisco-Backed Vendor

Morningstar Continues Private Markets Push with Allocator Investment

eVestment adds Enhanced Reporting Functionality for Fund Managers Using TopQ

iCapital Continues Expansion Push; Acquires Wells Fargo's Feeder Fund Platform

Virtual Analysts - the future of proprietary deal sourcing?

Our latest special report, produced in collaboration with udu, examines emerging 'Virtual Analyst' technology and the increasingly important role it's playing in proprietary deal sourcing channels:

What is a 'Virtual Analyst'?

How does the technology work?

Why is it so important in the current market?

How does adoption affect existing sourcing processes?

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

S&P, Preqin and the Death of the Private Capital Silo

Preqin and S&P’s data partnership is the latest in a series of high-profile deals involving private capital specialists and broader financial data and software providers. We have some strong views on this emerging pattern and what it means for end-users, vendors and those doing deals in the financial data and technology industry.