Our latest Special Report, produced in collaboration with Untap helps our users understand the portfolio monitoring and value creation sector, including selection considerations and criteria. It also contains a Product Brief covering Untap and our verdict of this platform.

Collaboration Intelligence & Knowledge Sharing - Sector In Focus

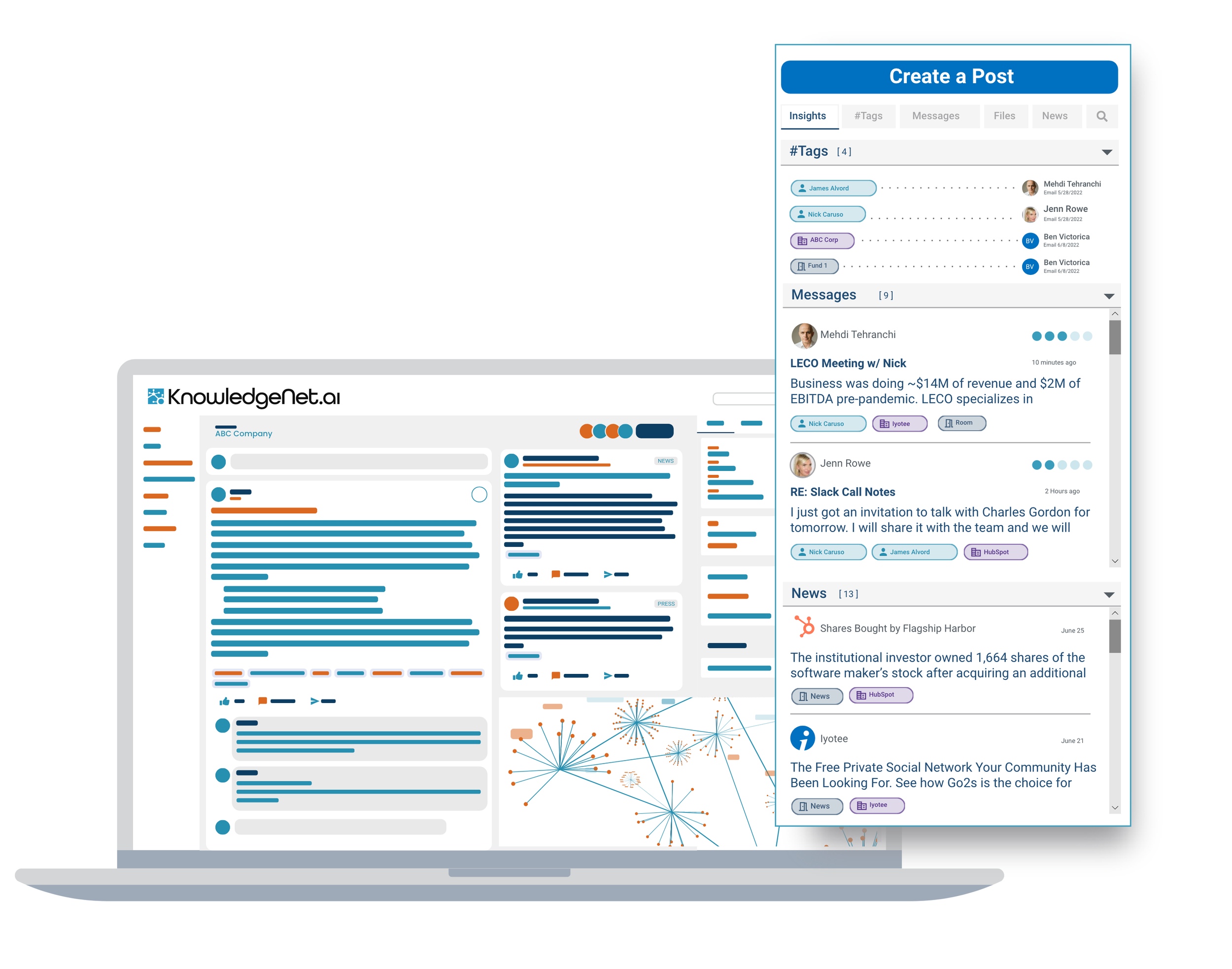

Collaboration Intelligence and Knowledge Sharing is an emerging area of technology with the goal of sorting through the huge amounts of data generated by a firm to identify patterns and surface intelligence to support and add context to human interactions taking place.

Our latest Special Report, produced in collaboration with KnowledgeNet.ai is designed to help our users understand the sector and gain an understanding of its potential to add value to their organization. It also contains a Product Brief covering the KnowledgeNet.ai platform and our verdict on this platform.

The Perfect Pitch? Here's What We Learned by Analyzing 50 SaaS Demos

How are Private Equity and Venture Capital Tech Firms Funded?

Bloomberg - Allocator Pricing and Penetration Report

LP Portals: The Most Important Investor Relations Tool?

Investor Reporting Software

The needs and requirements of private equity and venture capital LPs are evolving. While the personal relationships which historically underpinned a firm's ability to attract and retain LPs remain important, the asset class' increasing size and complexity is putting more pressure on LPs to maintain a robust portfolio based on frequent and high-quality analysis of existing and potential new GPs.

Managers coming to market today will experience a fundraising market unprecedented in terms of competition where providing access to high quality reporting tools and data on demand can make the difference in achieving a fundraising goal. It is essential for fund managers to align with LP demands for high quality reporting, and we believe that the choice is no longer whether or not to implement an LP Portal, but which one will most effectively serve to enhance a GP's brand among existing and potential new LPs.

What Makes for a Good Portal?

The LP Portal is often the primary means for investors to interact with a fund and therefore plays a big role in brand-perception. Many of the leading solutions will allow for a firm to brand the portal in their image, including eFront's Investment Café which facilitates customization to reinforce a firm's style and image. A good UI (user interface) is essential so the LP can find the information they are looking for and enter their own data easily.

The best LP portals will include data visualization, access via mobile devices and the ability to produce high quality reports for investors. Certain platforms, including Cobalt, feature native third-party data integrations to allow for the production and distribution of benchmarking reports.

As fund information is sensitive, the portal needs to be very secure. In fact, one of the best reasons to use a portal is due to potential issues with mail and email, both in terms of preparation and delivery. Products such as Altvia's Sharesecure are now utilizing enterprise-grade features such as two-factor authorization and virus scanning to ensure compliance and maintain security. Dynamic watermark creation is another feature which not only lowers the possibility of human error, but also saves IR professionals days of time over the course of a fund.

The trend among LPs from large pension plans to nimble family offices is for increasing demand for up- to-date, granular data about the fund's portfolio, prospective deals, cash flow and benchmarks. In addition, information related to sources of investor alpha, compliance and risk should be provided and forms a major part of offerings from firms such as LP Analyst. Firms seeking a solution designed primarily around facilitating due diligence can leverage tools such as eVestment's TopQ. Both LPs and GPs will appreciate the more prosaic aspects of a quality portal such as an easier and more secure transmission of their annual K1s along with the ability to upload changes in their address and banking information.

It all adds up to better customer service, brand building and relationship cultivation while leaving investor relations professionals with more time to engage in value-added activities instead of menial tasks. Certain platforms, such as Capital Dynamics spin-off Colmore, also offer outsourced investor reporting in addition to a quality portal which can further enhance the LP experience in a cost-effective manner.

Standalone vs. Suite?

One of the most common questions we hear at PE Stack is whether to build a collection of standalone applications, or select a single suite of services from one of the primary software suppliers, the majority of which offer portals. While each procurement process is different, there are some clear benefits to using a platform such as AltaReturn which offers users the ability to integrate back and front office tools with its investor portal.

PE Stack

Our Vendor Profiles platform tracks over 150 software and data vendors, including more than 30 which offer an LP portal. We help GPs, LPs and service providers to identify potential solutions via our free to use, powerful online database and by providing bespoke consulting services. For instant access, please visit www.pestack.com/vendor-profiles or email us at info@pestack.com

How to Choose a Data Provider

Back in 2011 I moved to New York to head up Preqin’s US operations, including sales, client services and marketing functions. I know a thing or two about selling data!

There are a lot of data companies in our industry. While no two are the same, all employ similar techniques to close a sale. We put together this insider guide to help you remain objective in the face of conflicting claims of superiority, take control of the selection process and empower you to procure the best services for your team.

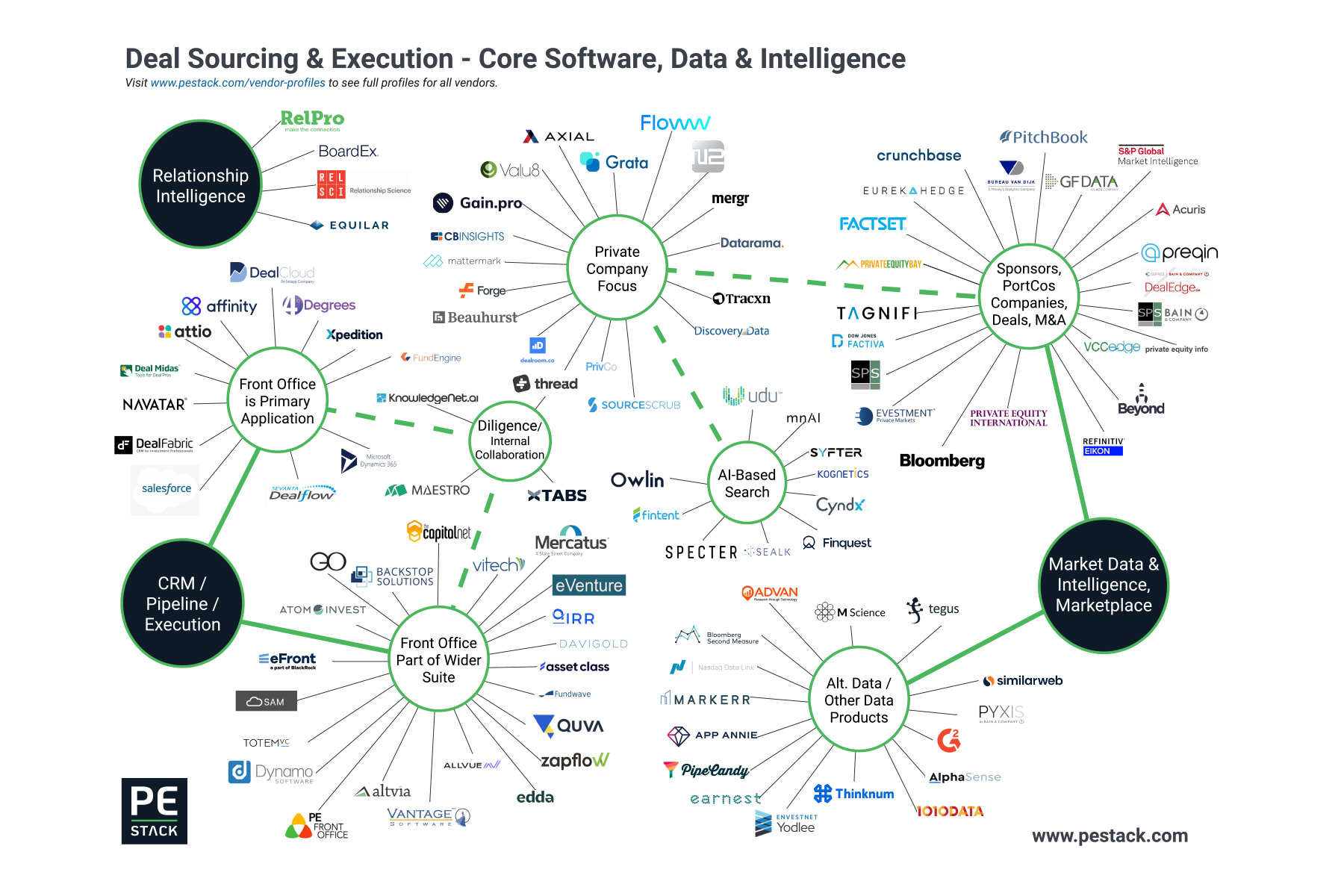

PE Stack tracks around 40 different data providers to the private equity and venture capital industry. We maintain detailed profiles for all of them on our powerful Vendor Profiles platform. It's free to use, and we even offer free procurement advice to our users!

Information Overload!

Procuring and maintaining the right mix of data and software providers is tough, so we wrote a guide on how to do it.

You can download it here: