PE Stack’s Tim Friedman sits down with the IHS Markit Private Markets team to discuss portfolio monitoring and technology selection strategy best practices.

Private Equity in 2025: How will the Industry be Defined?

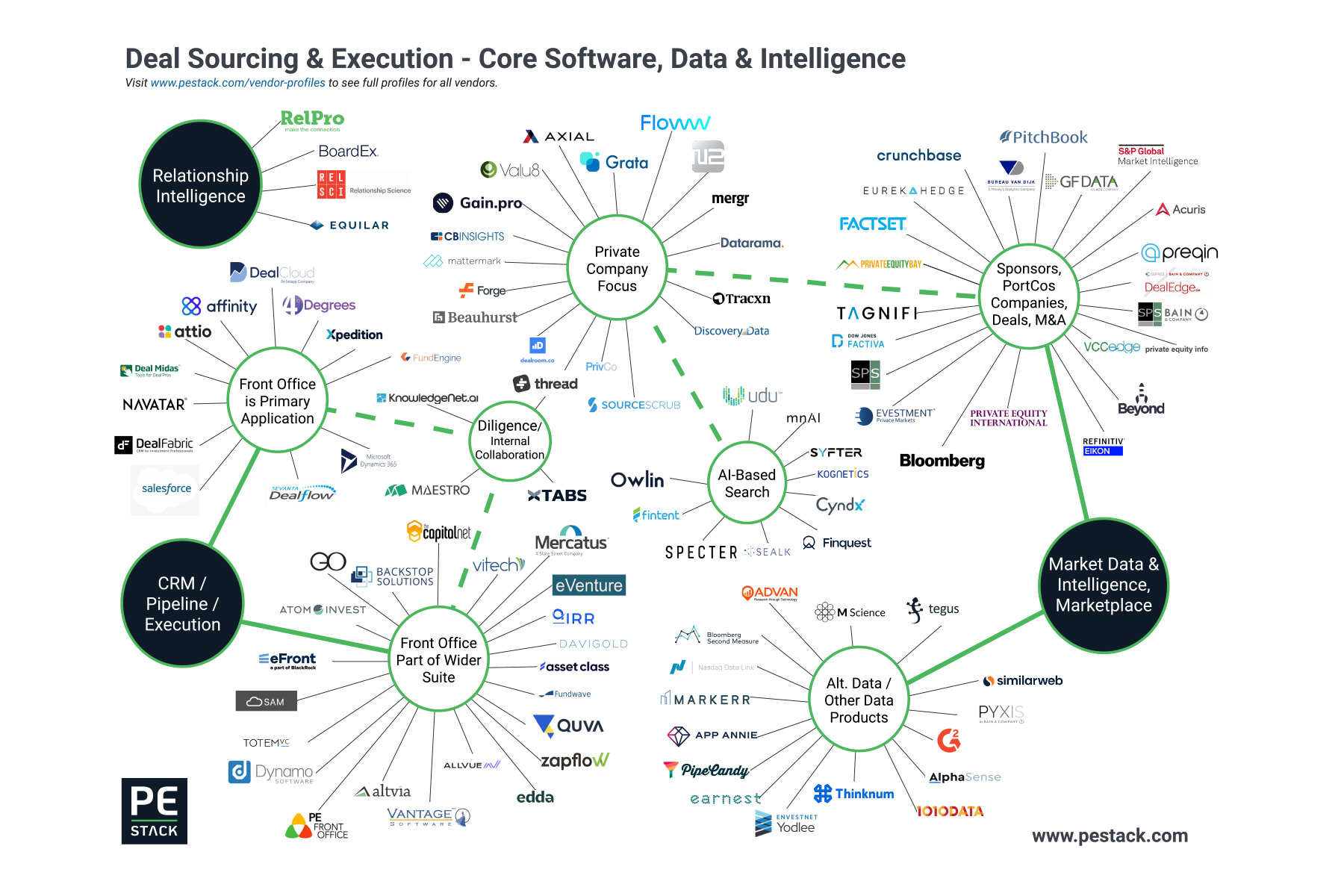

Market Data Integration: 5 Key Considerations

A software platform’s ability to integrate with leading industry market data sources is a key consideration criteria often subject to false assumptions and misinformation. In an effort to improve the alignment of expectations between buyers and sellers of private capital software and data, we’ve identified the five most important considerations to ensure no nasty surprises during implementation.

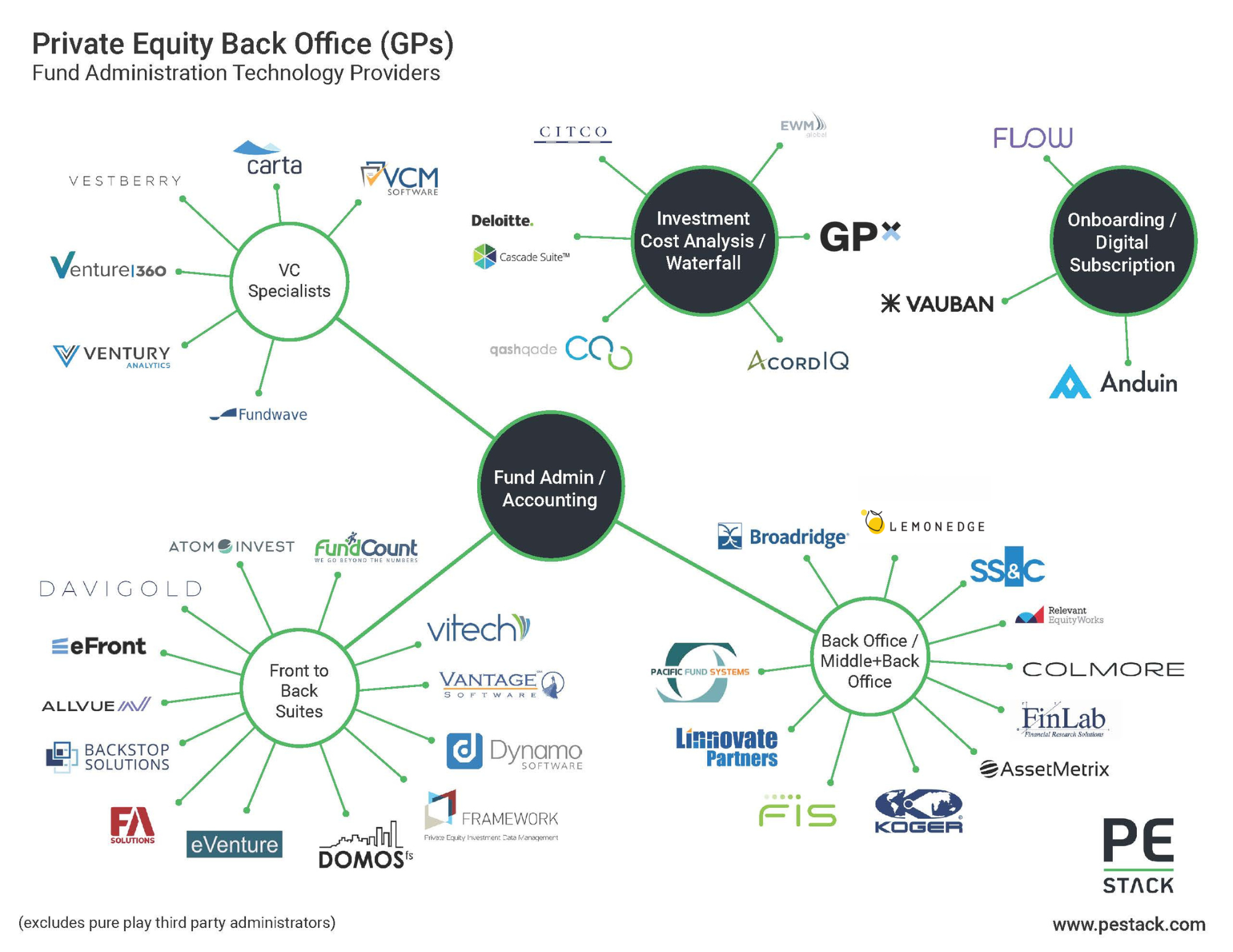

Why PE Firms Need a Data Strategy

For private equity firms, data forms the foundation from which opportunities are uncovered, decisions made and competitive advantages built. A robust strategy for the collection, structure and maintenance of data should therefore be of critical importance… but is all too often neglected or completely ignored.